In our recent webinar hosted by Stampix, we debated the pro’s and con’s of loyalty programs with prof. Byron Sharp, renowned author of “How Brands Grow” and Director of the Ehrenberg-Bass Institute for Marketing Science. He explained how brand loyalty is a natural, fundamental aspect of consumer behaviour, driven by our tendency to simplify our lives through routines. This behaviour is evident in various aspects of life, not just in brand buying.

Sharp illustrated this with everyday examples: people often return to the same restaurants, choose the same items from the menu, and remain loyal to their hairdressers or doctors – even when they move to another city. These habits demonstrate our inclination to create predictable patterns and stick to them, hence showing loyalty across different domains in life. Psychologists call this the ‘law of least’ effort, where our information-seeking behaviour stops as soon as minimally acceptable results are found.

However, Sharp pointed out that it’s very challenging to alter these loyalty patterns, which is the core objective of loyalty programs. According to his research, loyalty programs can only nudge consumer behaviour slightly, and generally produce very weak effects on overall loyalty. More importantly, they don’t significantly contribute to brand growth.

Caveat #1 - Selection Bias in Loyalty Programs

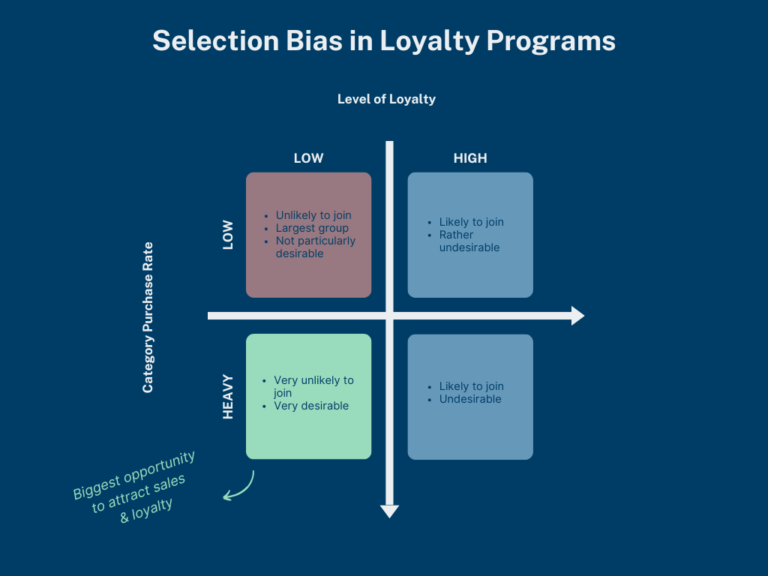

One of the key reasons loyalty programs often fall short is due to selection bias. Sharp explained that loyalty initiatives, whether through cross-selling, CRM, or formal programs that offer points, predominantly attract a brand’s heavier buyers. These individuals are already frequent purchasers of the brand, making them more inclined to join loyalty programs. In contrast, the non-loyal heavy buyers in the category are less likely to see the value in joining the program. This selection effect limits the potential of loyalty programs to recruit new, high-value customers from competitors.

Caveat #2 - Polygamous Loyalty and the Double Jeopardy Law

Sharp’s research also highlights that consumers are polygamously loyal, meaning they divide their loyalty among multiple brands rather than being exclusively devoted to one. A popular way of saying this is the quote from Andrew Ehrenberg ‘Your customers are really other brand’s customers who occasionally buy you.’ This behaviour is encapsulated in what’s called the Double Jeopardy Law, which states that larger brands (ie, with more market share) will have more buyers who are slightly more loyal, while brands with smaller market shares tend to have fewer and less loyal customers. This principle underscores that increasing a brand’s market penetration is crucial for growth. Brands with larger market shares are more likely to be chosen by light, occasional buyers of the category.

Do the laws from HBG also apply outside the FMCG category?

The panellists seemed to agree that loyalty investments are more likely to pay off for brands with high purchase value and frequency (customer lifetime value), or where the acquisition costs are very high. It seems that there are no benchmarks to help predict the likelihood of program success based on these parameters.

Another category where I believe loyalty is fundamentally different are Subscription markets (eg, insurance, credit cards, telecommunications). These are radically different because usually your customers exclusively buy your brand, and your classic loyalty metrics such as “share of wallet”, don’t make sense. Instead we look at metrics like defection (churn) and time until defection. A surprising outcome of Sharp’s research is that the so-called Dirichlet model (NBD-Dirichlet, negative binomial distribution), also fits well on the loyalty data available for credit cards. The Dirichlet model predicts the probability distributions of the consumer purchase incidences and brand choices based on the brand’s market share. For a deep-dive on this topic, we refer to the episode Subscription vs. Repertoire markets on the Let’s Talk Branding podcast.

Sharp raised Wells-Fargo as a real-world example of a loyalty program failure in another category. The bank’s efforts to cross-sell products to its existing customers resulted in fraudulent practices by employees under pressure to meet unrealistic targets. This scandal led to massive fines and the firing of thousands of staff members, demonstrating the pitfalls of trying to force loyalty where it naturally does not exist. During the webinar some discussion arose on this, and Denis Huré pointed out that the Wells Fargo cross-selling situation was unrelated to the loyalty program and occurred after the launch. He points out that the cross-selling issue came from the incentives put on the Wells Fargo employees (not the clients/members) to cross-sell products and services to their existing clients.

Conclusion: The Path to Brand Growth

In conclusion, Sharp emphasised that while loyalty programs can provide slight loyalty effects, they do not drive substantial growth. The primary driver for increasing sales and maintaining a brand’s health is acquiring new customers. For FMCG brands, this means focusing on increasing market penetration rather than relying solely on loyalty initiatives.

Understanding these dynamics can help marketers better design their strategies, balancing efforts between nurturing existing customers and attracting new ones to achieve sustainable growth. However, as pointed out by other panellists and several loyalty experts in the audience, loyalty programs are an effective way to build a customer database, provide a new channel to reach the consumer, maintain mental & physical availability and ultimately gather business insights.

SIGN UP FOR THE WHITE PAPER

We didn't have time to answer all questions from the audience during the webinar. Subscribe to our Newsletter to receive an exclusive White Paper with the key insights and answers from the panelists.